Calculate my after tax income

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. So your big Texas paycheck may take a hit when your property taxes come due.

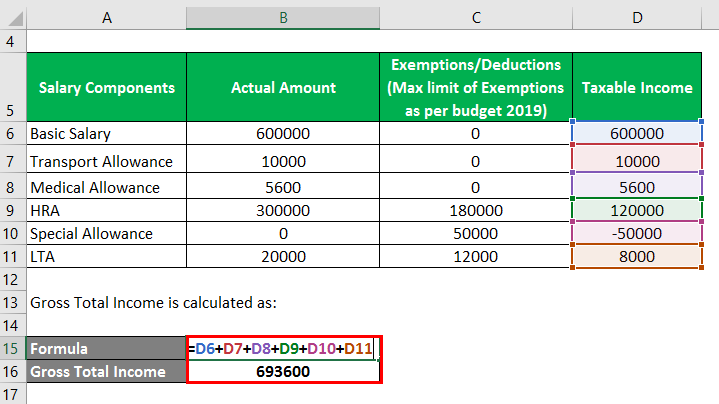

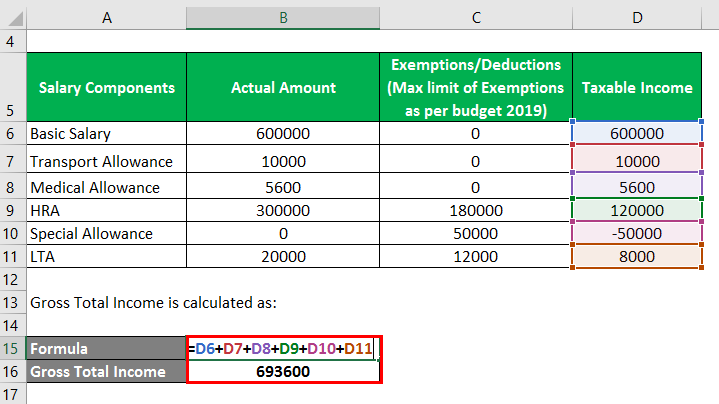

Taxable Income Formula Examples How To Calculate Taxable Income

Rates remain high in Melbourne where median weekly earnings top 1200.

. With five working days in a week this means that you are working 40 hours per week. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

18 of taxable income. Some states follow the federal tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Using the annual income formula the calculation would be. After deducting taxes the average single worker in Sydney takes home 53811 yearly or 4484 per month.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. What your take home salary will be when tax and the Medicare levy are removed. Annual Income 15hour x 40 hoursweek x.

This places Ireland on the 8th place in the International. That means that your net pay will be 40568 per year or 3381 per month. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023.

The additional rate of income tax 45pc for workers earning. That means that your net pay will be 37957 per year or 3163 per month. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. If you want to boost your paycheck rather than find tax.

Youll then see an estimate of. This places New Zealand on the 22nd place in the. Yes you can use specially formatted urls to automatically apply variables and auto-calculate.

40680 26 of taxable income. Income qnumber required This is required for the link to work. Unlock Your Access To Essential Financial Planning Tools Get Appointed Today.

People who earned less than 125000 annually or 250000 if filing. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Financial Facts About the US.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Your marginal tax rate. According to Mr Kwarteng this works out as an average tax saving of 170 next year for 31 million people.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. 17 hours agoThe income limits are based on your adjusted gross income AGI in either the 2020 or 2021 tax year. See How Easy It Is.

The average monthly net salary in New Zealand NZ is around 3 117 NZD with a minimum income of 2 157 NZD per month. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. How much Australian income tax you should be paying.

How You Can Affect Your Texas Paycheck. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. Helps you work out.

Maine paycheck calculator can be an amazing tool to learn how much net money you are going to get after the taxes and deductions on your paycheckUnfortunately just like in. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The state tax year is also 12 months but it differs from state to state.

It can be any hourly weekly or. Ad Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

It can also be used to help fill steps 3 and 4 of a W-4 form. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. This places US on the 4th place out of.

How To Calculate Net Income Formula And Examples Bench Accounting

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

How To Calculate Taxable Income H R Block

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Taxable Income Formula Calculator Examples With Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Annual Income Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

How Is Taxable Income Calculated How To Calculate Tax Liability

Excel Formula Income Tax Bracket Calculation Exceljet

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Net Pay Step By Step Example

Taxable Income Formula Examples How To Calculate Taxable Income