Estimate my taxes

You have nonresident alien status. If you pay less in estimated taxes you may face an underpayment.

Annual Income Calculator

Based on your projected tax withholding for the year we can also estimate your tax refund or.

. Your 2021 Tax Bracket to See Whats Been Adjusted. Ad Top-rated pros for any project. Ad Calculate your tax refund and file your federal taxes for free.

Answer each question by either clicking on the options shown or by entering dollar amounts or other. If you make 55000 a year living in the region of New York USA you will be taxed 11959. That means that your net pay will be 43041 per year or 3587 per month.

Estimating a tax bill starts with estimating taxable income. Automatically produce fully-burdened PLs by jurisdiction entity and line of business. Thumbtack - find a trusted and affordable pro in minutes.

Calculate Your Tax Refund With Ease. This tool uses the latest information provided by the IRS including annual changes and those due to tax reform. The formula is.

When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. The IRS made notable updates to the. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions.

The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming.

W-2 income. Ad Compare Your 2022 Tax Bracket vs. For post-tax deductions you can choose to either take the standard deduction.

If you pay more in estimated taxes you will get a refund within six weeks after the IRS accepts your tax return. Aprio performs hundreds of RD Tax Credit studies each year. Adjusted gross income Post-tax deductions Exemptions Taxable income.

Income taxes in the US. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars.

This box is optional but if you had W-2 earnings you can put them in here. It is mainly intended for residents of the US. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Ad Partner with Aprio to claim valuable RD tax credits with confidence. It will be updated with 2023 tax year data as soon the data is available from the IRS. Use your prior years federal tax.

Use this Self-Employment Tax Calculator to estimate your tax bill or refund. Enter your filing status income deductions and credits and we will estimate your total taxes. Compare - Message - Hire - Done.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Prepare and e-File your. Automatically produce fully-burdened PLs by jurisdiction entity and line of business.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Answer A Few Questions And Get An Estimate. And is based on the tax brackets of 2021 and.

Meaning your pay before taxes and. In a nutshell to estimate taxable income we take gross income and subtract tax deductions. How to calculate Federal Tax based on your Annual Income Simply enter your Annual earning and click calculate to see a full salary and tax illustration Use the advanced salary calculations to.

Are calculated based on tax rates that range from 10 to 37. Restart This Tax Return Calculator will calculate and estimate your 2022 Tax Return. Unlike your 1099 income be sure to input your gross wages.

You would have to. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. You may be able to annualize your income and make an estimated tax payment or an increased estimated tax payment for the quarter in which you realize the capital gain.

Discover Helpful Information and Resources on Taxes From AARP. Get a free estimate today. Estimate your tax withholding with the new Form W-4P.

Whats left is taxable income.

Self Employed Tax Calculator Business Tax Self Employment Employment

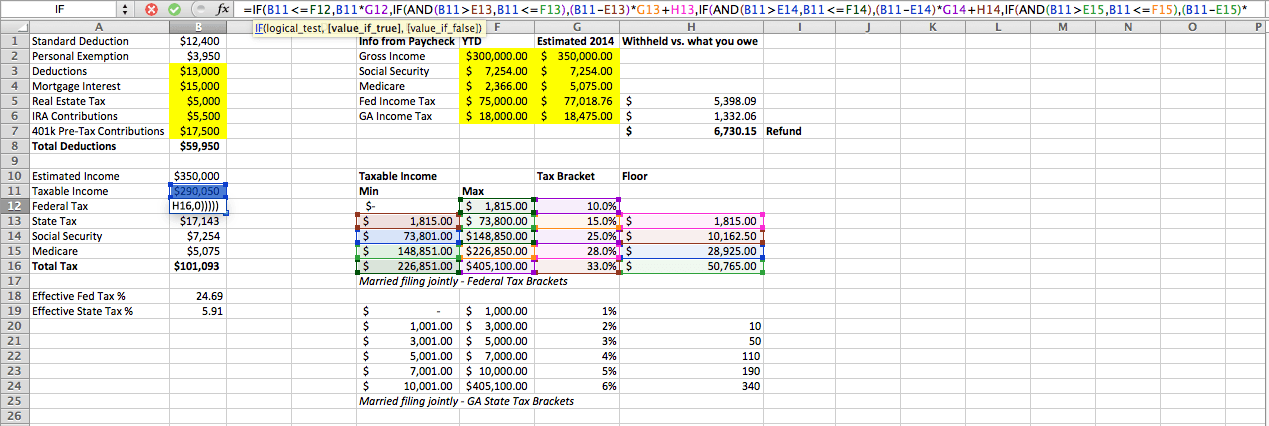

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

How To Calculate Income Tax In Excel

Completing A Basic Tax Return Learn About Your Taxes Canada Ca